“The economic case for investment is not strong enough at this time, as well as having the potential for delays,” a Shell spokesperson said in this BBC article published yesterday around the news of Shell pulling out of the Cambo development.

It is a blow for the industry, for Siccar Point and the West of Shetland. It is also a decision that not many industry insiders saw coming, as the general feeling seemed to be that Cambo would ultimately be given the go-ahead in the light of the UK government acknowledging that domestic production of hydrocarbons is important.

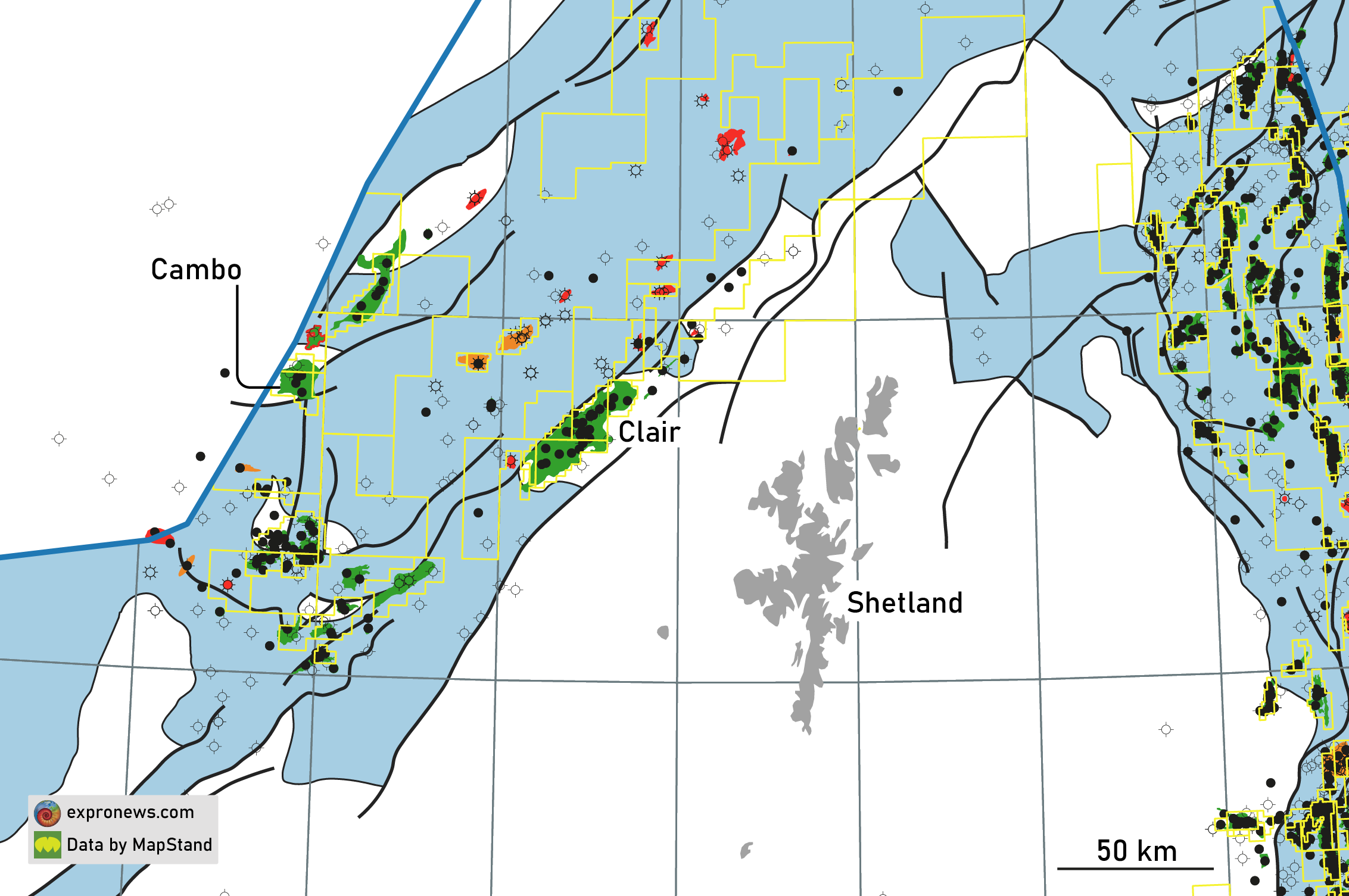

The Cambo field, which contains over 800 million barrels of oil in place, is located in the Faroe-Shetland Basin on the Atlantic margin. It was discovered in 2002 by Hess on a large basement high at the southern edge of the Corona Ridge. Five appraisal wells were drilled prior to acquisition by Siccar Point through the purchase of OMV in 2017. Shell farmed in in 2017 and the partnership drilled one more appraisal well in 2018, which was successful. Until yesterday, the field was operated by Siccar Point at 70% on behalf of joint venture partner Shell UK Ltd (30%).

The Eocene Hildasay reservoir sands are poorly consolidated and typically have excellent reservoir quality sandstones with average core porosity of >30% and multi-darcy permeabilities. Oil present in the Cambo Field is moderately biodegraded with a gravity of 22-25 API and a viscosity of 3-12 cP at reservoir conditions.

COP26

Given the attention Cambo drew in the lead-up to the COP26 Conference held in Glasgow last month, with the resulting questions asked to both the Scottish and UK Governments how long oil and gas production will be supported, it looks as if Shell’s decision comes at the right time for Westminster. Now, politicians do not need to vote on this for a while.

A rethink

This is not good news for private-equity backed Siccar Point. The company launched a process to sell up back in 2019. It was structured as various “transaction perimeters” (individual assets or combinations of). There was quite a lot of interest but the whole thing was pulled on the back of the oil price collapse in relation to Covid. Now, the two Siccar owners, Bluewater and Blackstone, have choices to make. Perhaps they need to think about selling their other assets in order to recoup some of their investment.

100% operator

With an experienced producer as Shell being lost though, the project has lost some of its credibility. Although Siccar Point was going to be the operator, given the scale of the project it must have been a positive aspect to have a broad E&P company involved. Will the OGA approve the field to be developed 100% by Siccar Point, if the company would even be able to secure the funds to do so?

Project delays

It is also interesting that the Shell spokesperson mentions the potential for project delays as one reason to pull out of Cambo. Is a reference being made to the Penguins redevelopment here? In February this year, Upstream reported that the China-built facility for Penguins should have sailed in January, but now it is only expected in 2022.

All in all, the economic case for Cambo remains, and the next few months will hopefully see how the project is carried forward.

HENK KOMBRINK