Bringing Exploration Opportunities in Jamaica Into Focus for an Energy Transition Future

Demand for New Exploration Projects is Anticipated to Increase

In the last 50 years, the upstream sector has experienced successive cycles of boom and bust at times of global economic or political change. Every cycle has been different, but one thing which has changed little is that exploration is usually the first thing to be cut in a downturn and the last thing to return when demand increases. While the world is rightly turning its attention to sustainable energy sources to power cultural and industrial advances into the future, there is an increasing understanding that traditional hydrocarbon-based energy sources will be part of the energy mix for the coming decades of transition. During this time there will be a sustained emphasis on efficiency and carbon offset and reduction. However, the need for new exploration is clear, to provide energy security while we move through this transition.

As news reports increasingly confirm, demand for energy has rapidly returned to pre-Covid-19 pandemic levels. However, unlike previous industry downturns, a lack of funding for exploration and production activities over the last seven years will have an impact on future supply. An emphasis on carbon neutrality and sustainability has led to less funding for exploration. However, with new technologies and increases in efficiency, future developments have the potential to be far less carbon intensive than previously, and in many instances could be carbon neutral or even carbon negative through their lifecycle.

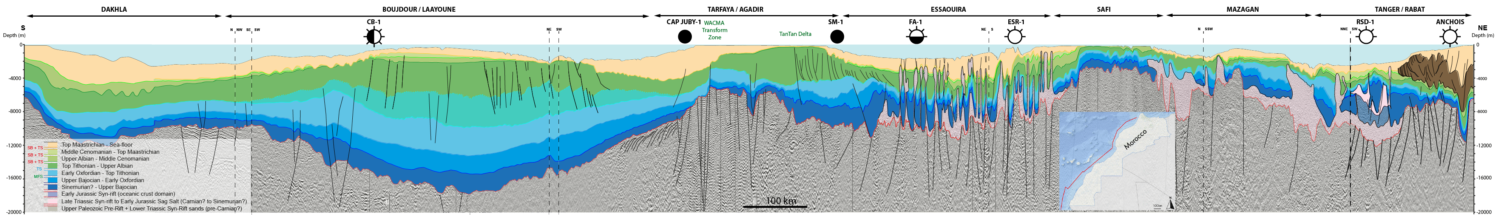

The reality is that new oil and gas reserves will be needed to meet demand. This will arguably lead to new exploration being necessary as recent successful play developments such as those offshore Ghana, Senegal, Mozambique, Suriname and Guyana mature, and incremental reserve replacement from these plays reduces. Couple this with the fact that unexplored areas with stable political and attractive fiscal regimes are becoming scarcer.

This is where Jamaica fits in

Jamaica is a country where traditional oil and gas exploration and renewable energy development could work handin-glove. Abundant solar, wind and sea-energy resources exist and await harnessing, while the offshore basins of Jamaica have had very little exploration to date. Only two wells have been drilled offshore, with the most recent one in 1982. However, both wells, along with all nine wells drilled onshore have shown evidence of an active hydrocarbon system, so the potential for discoveries in the large offshore area is huge.

United Oil & Gas plc, an AIM-listed, full-cycle E&P company, currently holds 100% interest in a low-cost, high-return, basin-opening exploration opportunity offshore southern Jamaica, namely the Walton Morant Licence. This covers a large area of 22,400 km2 and includes two prospective basins: the Walton Basin in the west and the Morant Basin in the east. United farmed into the previously Tullow Oil-operated licence in 2017 for a 20% interest by funding the acquisition of a 3D seismic survey targeting some of the key plays and prospects in the Walton Basin. However, before they could validate this potential, Tullow exited the licence in 2020, as part of their corporate restructuring to refocus on development of their successful discoveries elsewhere. This gave United the opportunity to take 100% of the licence interest and to continue to work towards realising the Walton and Morant Basins’ exploration potential. United has been granted an extension of the licence until January 2024 in order to attract an industry partner and to unlock the offshore potential by drilling the first well in 40 years.

With one eye to the future, as part of United’s work programme for 2022–2024, the company has committed to undertaking a carbon intensity study which will look at the options available to substantially reduce any future field developments’ carbon impact through the implementation of best practice carbon-capture efficiencies and the development and use of renewable energies to provide power for any hydrocarbon production as well as for local communities.

World-class frontier exploration

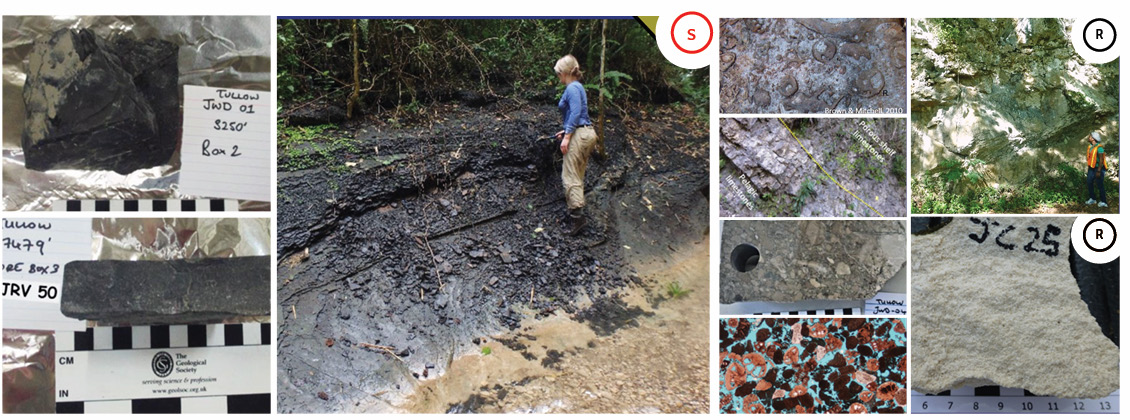

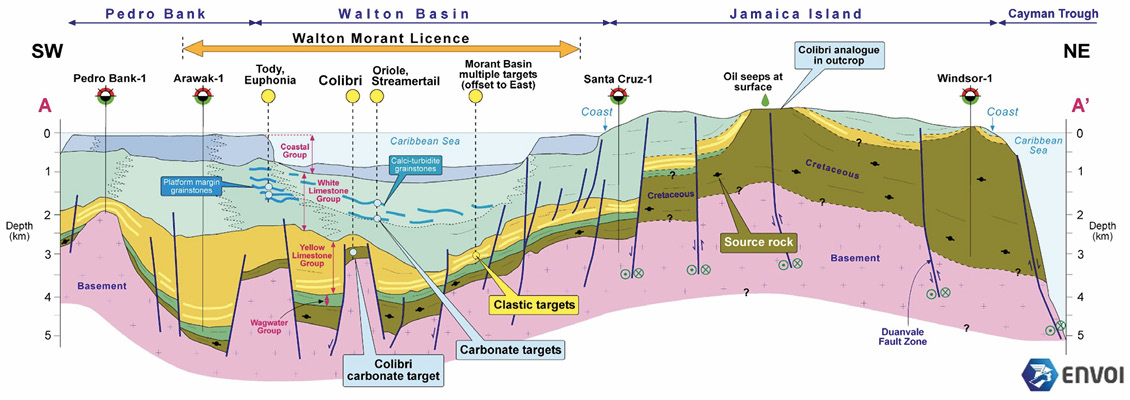

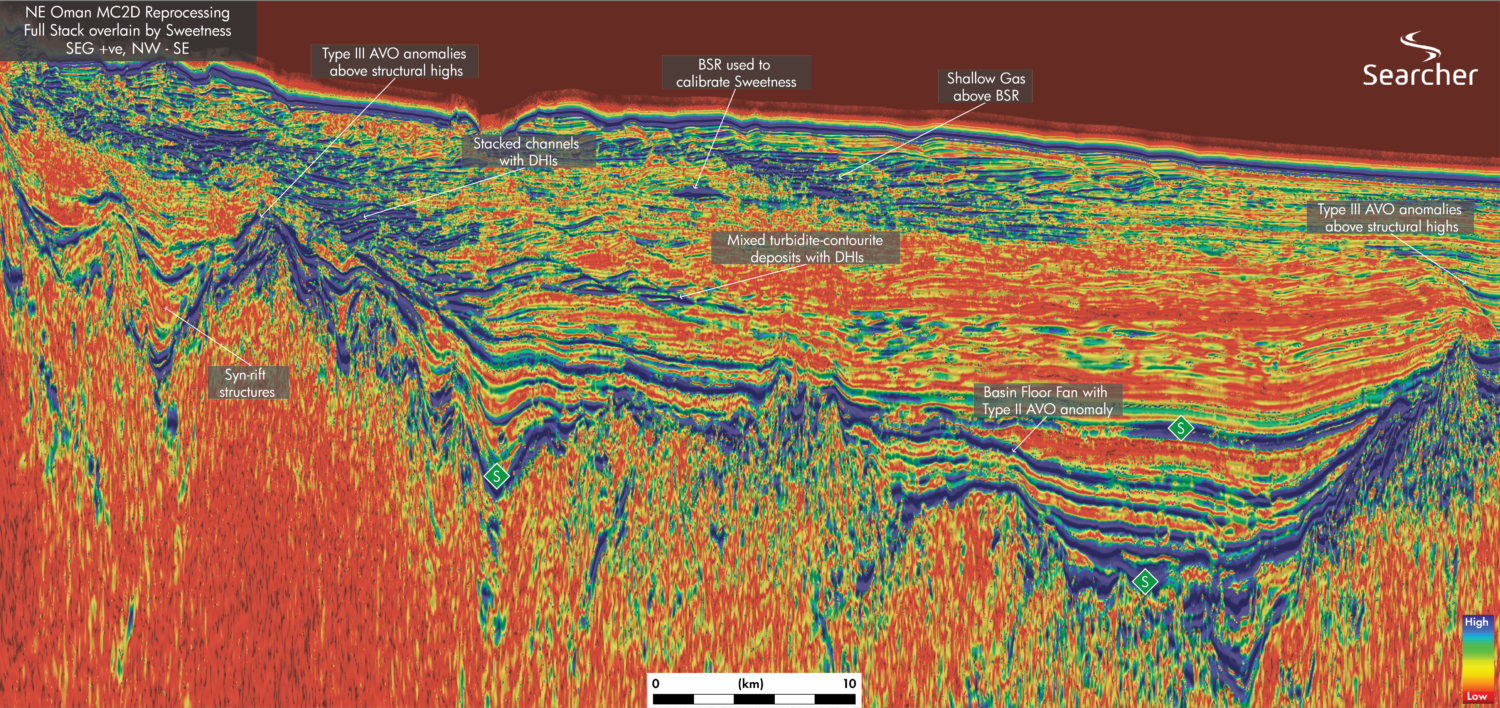

United’s work programme has established that although the Walton Morant Licence is in a frontier basin, all the elements of a working hydrocarbon system are present. The unique tectonic history of the Caribbean, resulting in the Miocene to recent uplift of the island of Jamaica, provides a window into the petroleum geology of the offshore through the onshore outcrops.

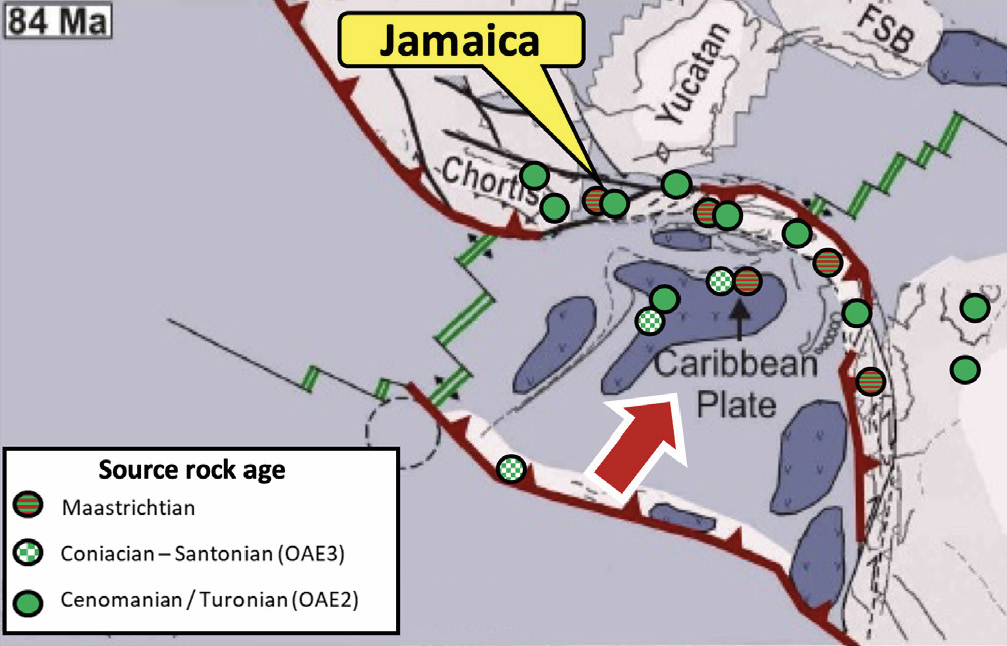

A detailed understanding of the region’s tectonic and paleo-geographic history has also shed light on how the major, Cretaceous-sourced hydrocarbon provinces of the Caribbean region present today, originally lined up in a contiguous ‘source rock fairway jigsaw’ at the time of deposition. Since then, the ‘jigsaw’ has been redistributed through continued tectonic movement, with the pieces now found throughout the Caribbean region, including in areas such as Colombia, Honduras, Venezuela, Trinidad & Tobago and Jamaica.

The licence incorporates highly prospective stacked Cenozoic and Cretaceous multi-play potential in the Walton Basin and Cenozoic potential in the Morant Basin, all of which have analogues or lateral equivalents encountered onshore, either in outcrop or in cored well sections. Water depths range from less than 50m to over 1,000m and 2,000m, in the Walton and Morant Basins, respectively.

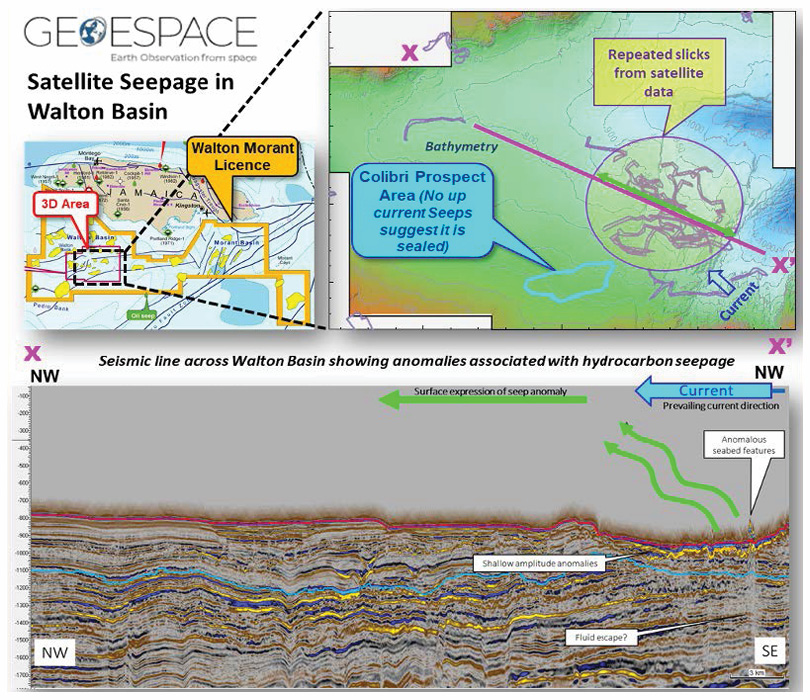

As well as the regional and local evidence for a working hydrocarbon system, live hydrocarbon seeps have been found in Jamaica, both onshore and offshore. Satellite imagery also shows evidence for an active oil seep anomaly which corelates with some interesting features on seismic, and shows evidence for migration near to, but crucially not associated with the primary prospectivity identified in the Walton Basin. Offshore southern Jamaica is therefore now considered as a preserved piece of the Cretaceous source jigsaw, containing substantial hydrocarbon play potential through different stratigraphic levels as seen in the uplifted onshore, and preserved in the offshore, with evidence for active hydrocarbon migration.

The Walton Morant licence opportunity – multi-basin, multi-play, billion-barrel potential

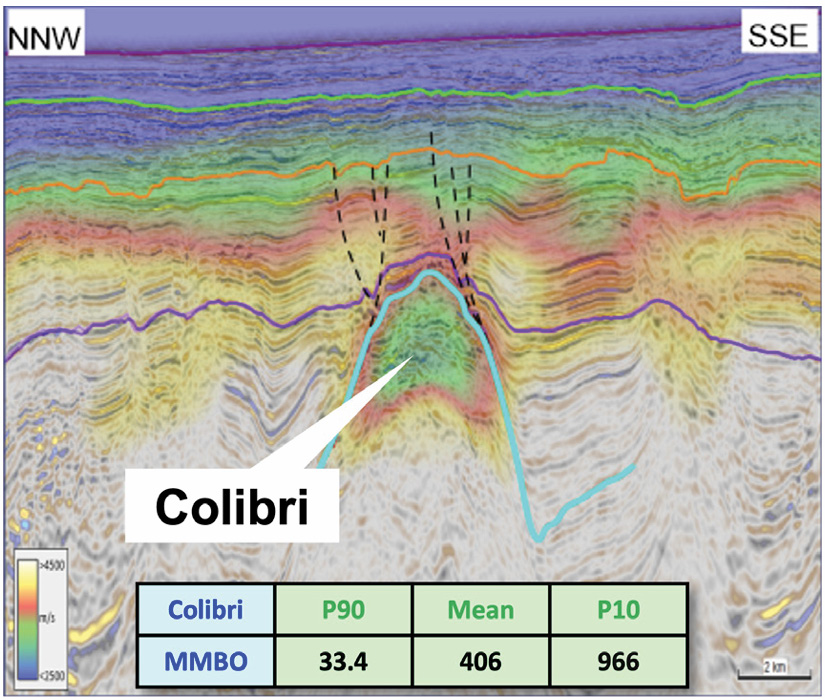

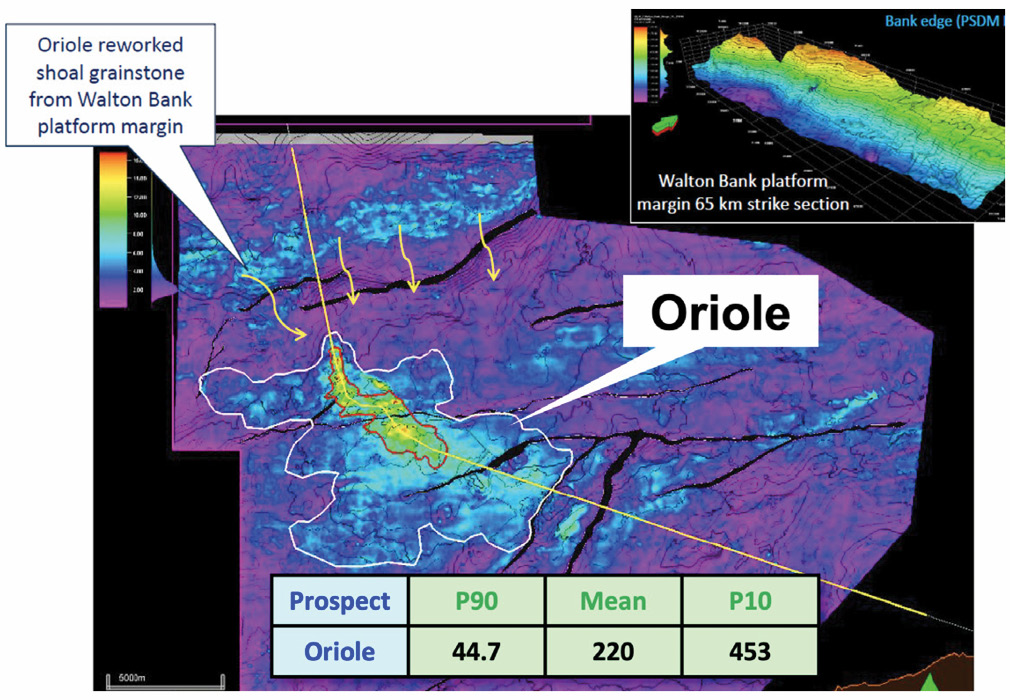

United have high-graded 11 prospects and leads on 2D (3,650 km, shot in 2016–2017 across the Morant and Walton basins), and 3D (2,250 km2 shot in 2018 in the Walton Basin) seismic. These have been independently estimated by Gaffney Cline & Associates to have a combined mean unrisked recoverable resource potential of over 2.4 billion bbls recoverable, with an upside of over 5 billion bbls recoverable. On its own, the primary 3D-defined ‘drill-ready’ Colibri Prospect in the Walton Basin is estimated to have 406 MMbbls mean unrisked recoverable resource potential, with an upside of >900 MMbbls.

The economics are very robust and confirm that the favourable fiscal terms in Jamaica would ensure that commerciality would be possible in any basin-opening discovery containing recoverable resources in excess of 100 MMboe (at US$60/bbl). Equally, a discovery of the mean 406 MMboe resources at Colibri would still be commercial with an oil price as low as US$30/bbl. At US$60/bbl, the mean Colibri resource potential is estimated to be capable of generating a >30% IRR and an NPV10 of US$2.5 billion.

United is offering a material interest and operatorship to suitably qualified parties in the licence in return for a commitment to fund a well to test the Colibri Prospect before January 2026, which would fulfil the obligations for the second exploration period of the Licence. A 2021 study by OPC estimates this well is likely to cost around US$30 million based on current rig rates.

Note: All prospect and lead volumes quoted in this article are as per a prospective resources audit carried out for United Oil & Gas by Gaffney Cline & Associates, December 2020.

The images in this digital version of the original article have been scaled down to keep page loading times optimal. You can download and view the original article here (pp64-68).