The greater J area continues to be a drilling hotspot. But now it is Shell’s turn to prove commercial volumes, following several a three-well campaign by Harbour slightly further north last year: the Talbot appraisal campaign, the Jade South well (30/2c-J13) and the Dunnottar exploration well (30/08-4).

A big difference with respect to the wells drilled by Harbour though, is that 30/14a-5 targets a cross-border prospect. And if successful, it will even share its cross-border nature with a field that partly overlies the prospect: the Flyndre field. So, all in all, an exciting campaign to follow.

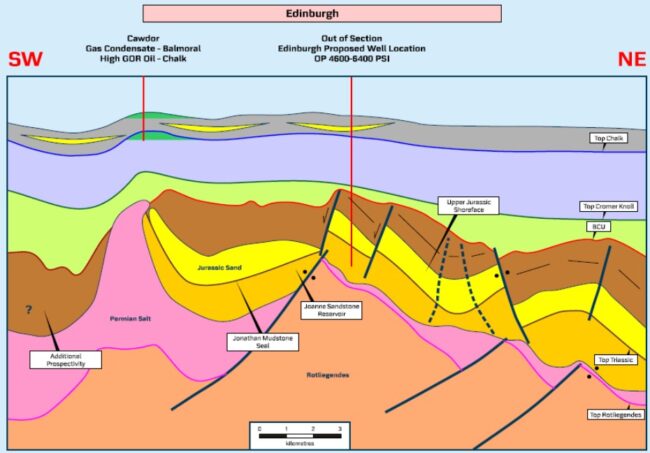

The presence of the Flyndre field, which hosts oil in Paleocene Balmoral sandstones, also explains why there are already two wells within the perimeter of the Edinburgh prospect. However, these wells terminate in the Upper Cretaceous and the Paleocene, leaving Edinburgh untested thus far.

Attend the NCS Exploration – Recent Discoveries Conference – 8 & 9 June in Oslo – and hear about the Gomez well DNO drilled a little further to the east in Norwegian waters last year. Gomez is an interesting example of a Paleocene target in an area where the Upper Cretaceous has been the dominant play thus far.

Four licences

Maersk relinquished the licence covering the Edinburgh prospect in 2017, following a campaign during which it failed to secure a farm-in partner. Faroe Petroleum subsequently applied for the acreage in both UK and Norwegian waters, with Shell and Spirit Energy farming in in 2019. As Faroe Petroleum was subsequently acquired by DNO, the landscape in all four licences (UK P255 & P2401 and NO O18 ES & PL969) covering the Edinburgh prospect is as follows: Shell (40%, operator), DNO (45%) and Spirit Energy (15%).

High pressure high temperature

The targeted reservoirs of the Edinburgh constitute the Upper Jurassic Fulmar sandstone as well as the underlying Joanne Sandstone Member of the Skagerrak Formation at a depth well within the HP/HT range. The prospect relies on multiple sealing mechanisms, including dip, fault and salt sealing. These elements can all be observed in the cross-section above.

The well Shell is now drilling is located slightly further to the southwest than the location Maersk had proposed; maybe the company wanted to to stay a little bit further away from the salt wall that bounds the prospect in the north and the west.

Given the HP/HT conditions, Maersk expected the fluid to be gas condensate. The estimated volumes the Danes report in the relinquishment report range from 6 – 210 MMboe, with a 35 MMboe being the P50.

Watch this video from TROVE for more information about Edinburgh, especially why Shell is well-placed to drill this challenging prospect in the light of drilling experience in similar settings elsewhere.

HENK KOMBRINK