The basins of interest span from the Pelotas of southern Brazil and Uruguay, through the Punta del Este and into North Argentina. Historically, this has been an underexplored region, with relatively few exploration wells drilled in its extensive >500,000 km2 area. However, a number of international companies – including supermajors – have now established acreage positions, and with work programme commitments estimated to be well in excess of $500m, the area is going to see significant activity over the coming years.

Geology

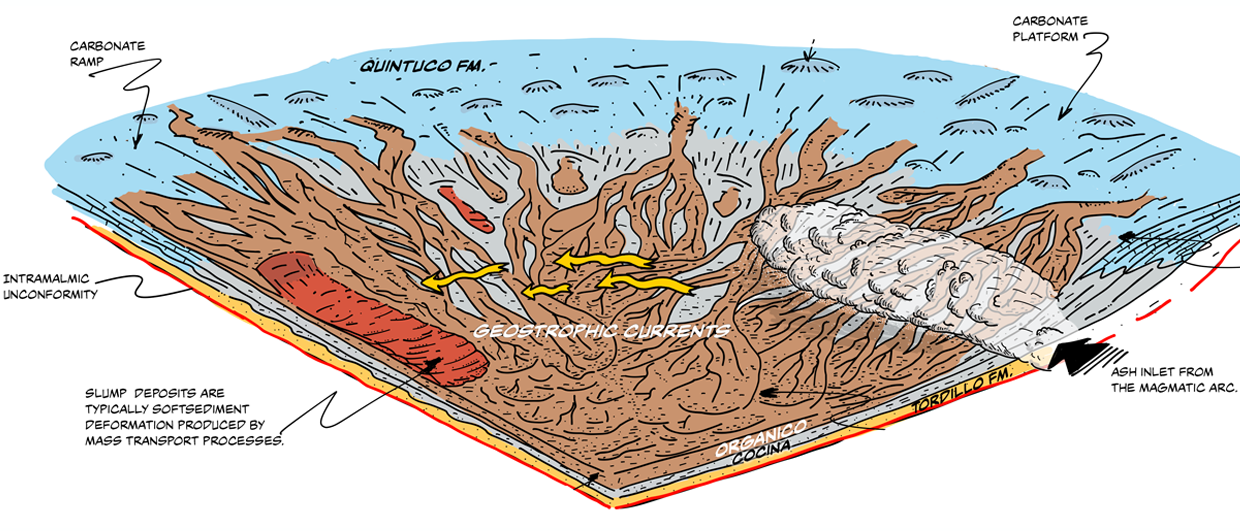

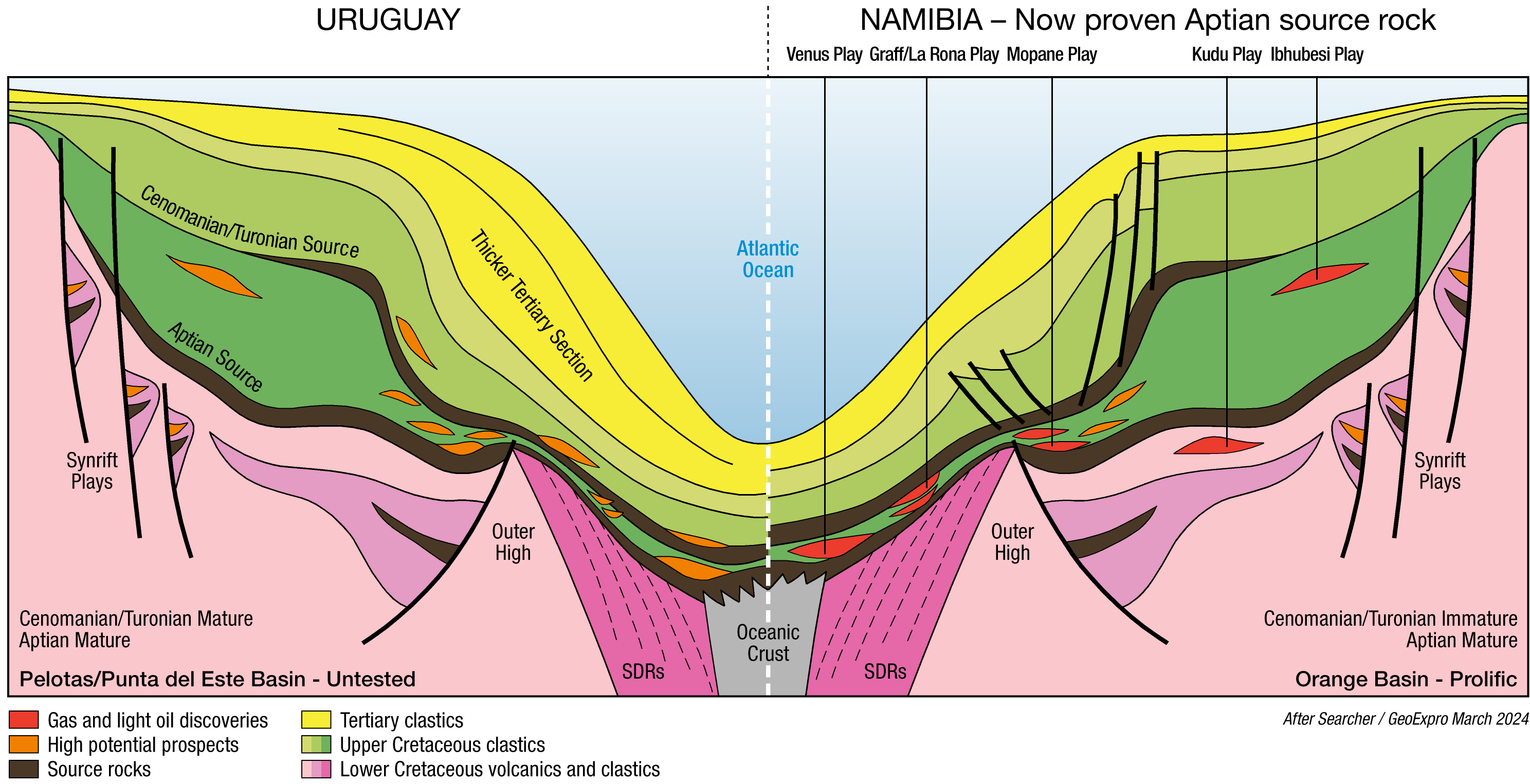

The recent discoveries offshore Namibia have been made in Apto-Albian basin floor fans and Upper Cretaceous turbidites charged by a Lower Cretaceous Aptian source rock. Although there are differences between the Namibian and South American passive margins, with a noticeably thicker Tertiary section on the South American conjugate, the same Aptian-aged source interval that is present in the Namibian Orange Basin can be seismically correlated across to South America. With Cenomanian-Turonian source rocks also potentially developed and mature, and the identification on seismic of similar reservoirs to those encountered in the Venus and Graff discoveries, it is not surprising there has been so much recent interest.

Pelotas Basin, southern Brazil

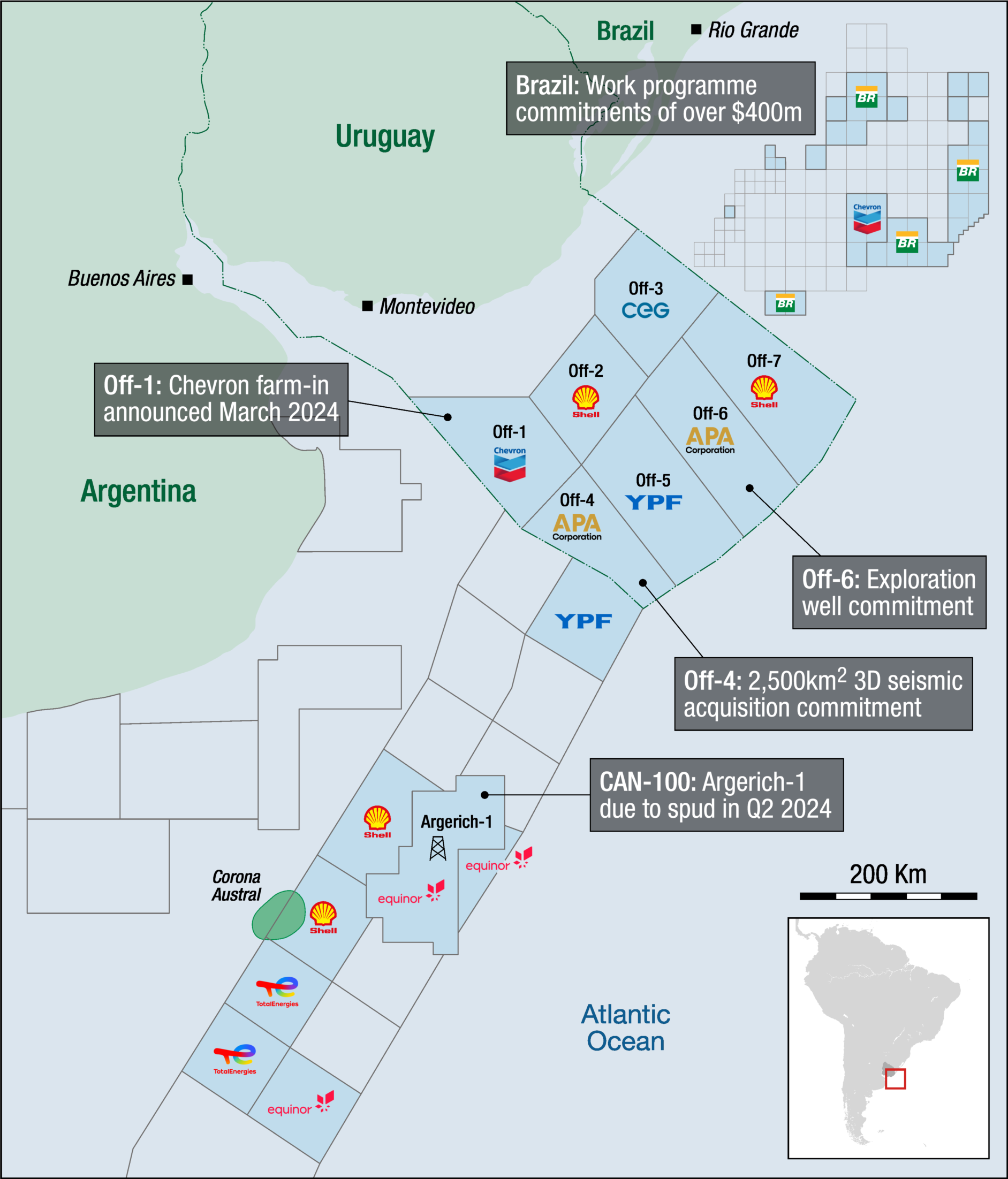

In December 2023, 44 Blocks were awarded in the Pelotas Basin in the 4th Cycle of Permanent Offers. The companies receiving awards included Petrobras, Shell, CNOOC, and Chevron. With signature bonuses exceeding $60m, and work programme commitments close to $400m, significant activity can clearly be expected there.

Pelotas and Punte del Este Basins, Uruguay

The entire available offshore acreage in Uruguay has now been licenced, with Shell, Apache, and YPF entering the country in 2022 and Challenger Energy most recently confirming award of the final licence, OFF-3, in 2024. Work commitments for the next 3 to 4 years include the acquisition of 2,500 km2 of 3D seismic (Area OFF-4, Apache/Shell) and the drilling of an exploration well (Area OFF-6, Apache).

Chevron have also entered offshore Uruguay again after an absence of around 50 years, with a farm-in deal with Challenger on Block OFF-1 announced in March 2024. Under this agreement, Chevron will fund the acquisition of 3D seismic in 2024/25, with the intention of drilling a well in 2027. With a further nod to the potential ties to Namibian success, Charlestown Capital have taken a major investment in Challenger Energy. Charlestown are a major shareholder in Sintana Energy, already well-exposed to a number of exploration campaigns in the Namibian Orange Basin.

North Argentinian Basin, Argentina

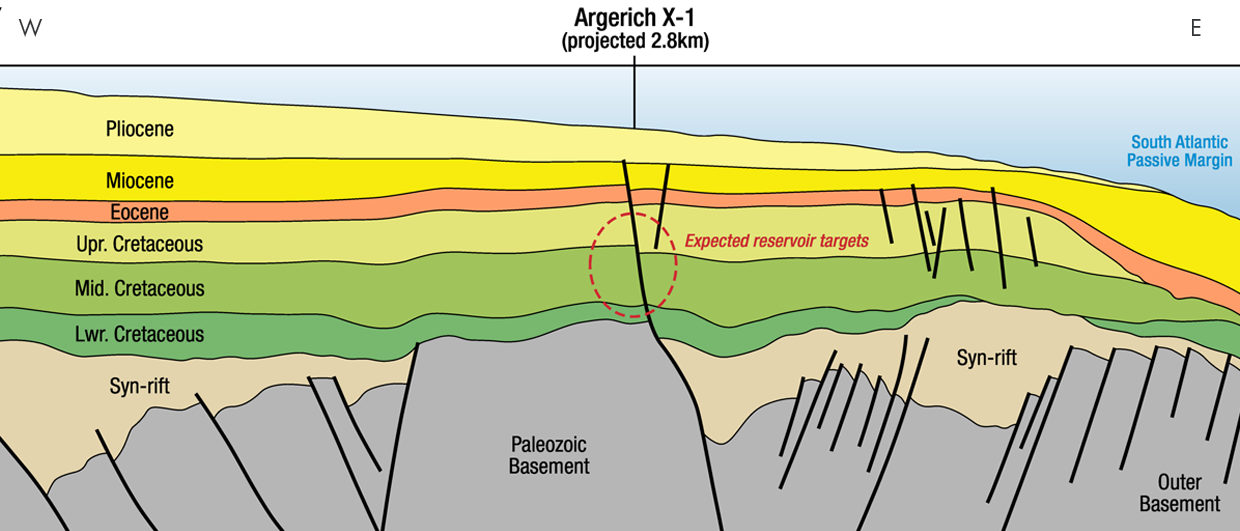

Moving further south along the continental margin and into Argentina, acreage holders include Equinor, YPF, Shell, TotalEnergies, and BP. Equinor and YPF are reported to be acquiring 3D seismic on Blocks CAN-102, CAN-108, and CAN-114 in 2024, with Shell and TotalEnergies also likely to be acquiring new seismic over their blocks this year. Argentina’s first deepwater well, the Equinor-operated Argerich-1 in Block CAN-100, is understood to have spud. This is targeting Cretaceous-aged reservoirs and as an initial test of the conjugate margin will no doubt be closely watched by operators and acreage-holders on both sides of the Atlantic.

A South American exploration hotspot

The South Brazil-Uruguay-North Argentina conjugate margin to the Namibian offshore basins has very rapidly become a South American exploration hotspot. With supermajors now holding large acreage positions, extensive 3D seismic acquisition soon to get underway, and at least 3 wells planned to be drilled by 2027, this is definitely a region to watch – and could well be where the next basin-opening discovery of global impact is made.