The curtain is yet to come down on oil and gas wildcatting for the West Africa margin, as explorers continue to break new ground in new basins, in a world hungry for hydrocarbons. The Jaca 1 well to the east of São Tomé is an example of that.

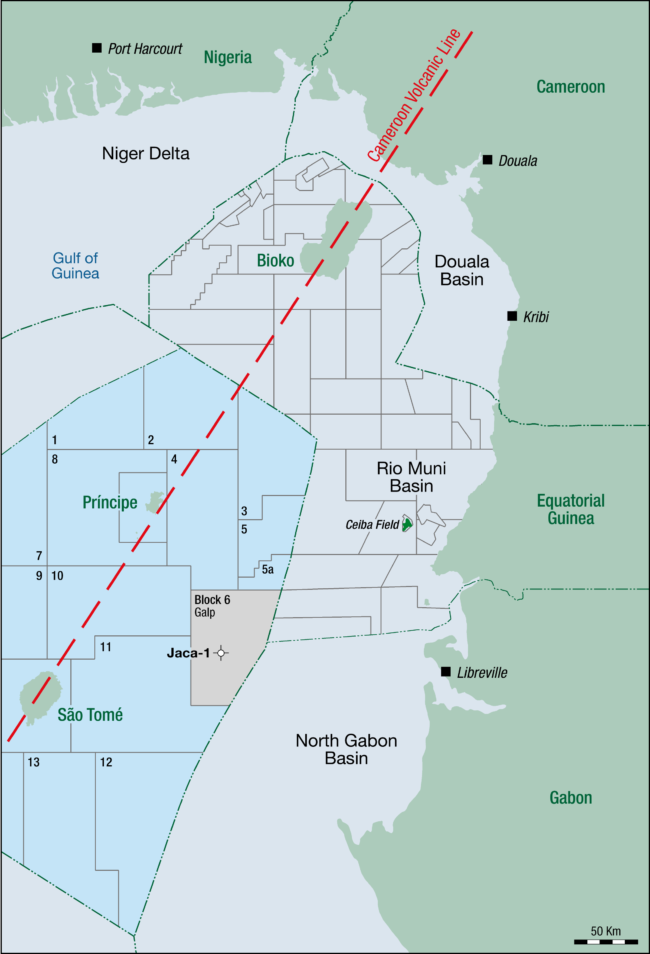

The first blocks in the São Tomé and Príncipe Exclusive Economic Zone (EEZ, (blue colour in the map) were awarded separately to Equator Exploration and Oranto in 2010, who added to the multiclient 2D seismic campaigns acquired by PGS between 2001 and 2005 with proprietary 3D seismic surveys over Blocks 5 and 12 and further geological studies. These induced a string of new entrants to bring new investment in 2016.

Kosmos Energy spearheaded the campaign, farming in to four contiguous blocks against the border with Gabon and Equatorial Guinea. The US based firm, well known for cracking the Upper Cretaceous West Africa play from Ceiba to Jubilee in Ghana, saw an amplitude anomaly in Late Cretaceous horizons that coincided with a deep marine depositionary model of turbidites and fan systems being fed by the Rio Muni coastal basin to the northeast and the Ogue fans to the east and south.

Soon after Kosmos joined Equator/Oando, major firms such as Shell, BP, Galp and TotalEnergies took large contiguous positions across the basin. TotalEnergies had already had limited success in the Joint Development Zone (JDZ) to the northwest of the CVL, but this play is very much associated with the thrust front of the Oligo-Miocene Niger Delta play. Since 2016, a number of large 3D surveys have been acquired, and while Shell has consolidated its position, Kosmos Energy cut short its “third innings” and exited most of their blocks in a broad West African transaction with Shell (with the notable exception of Block 5, to the north of the Jaca well).

A different source rock

This untested frontier play is supported by a number of structural ridges formed by transform faults running northeast-southwest through each block, adding structural and trapping opportunities to a high-impact Cretaceous clastic play. In this area the Lower Cretaceous formations, sitting on oceanic and proto-oceanic crust, provide potential source rock facies deposited during the early spreading phase of the South Atlantic.

These Lower Cretaceous source rock concepts have since been de-risked in other major West African basins as seen at the GTA and Sangomar discoveries in Senegal, and most recently at Venus and Graff in the Orange Basin of Namibia. Most West African wildcatting at the time of Kosmos’ entry relied on the prolific Cenomanian – Turonian (CT) source kitchen across the transform margin and the passive margin of the Gulf of Guinea. For reservoir analogues, a strong correlation is to be found to Late Cretaceous Campanian and Santonian sands at Ceiba to the east (Equatorial Guinea) and deepwater wells in northern Gabon, but the source rock and charge story would be a new test of this Early Cretaceous model.

Follow-up potential

A discovery at Jaca 1 could de-risk nine deep-water blocks and 50,000 sq km of frontier acreage. The well will target Upper Cretaceous Campanian and Santonian turbidite and slope sands, some of which are draped over, or pinch out against, elongated ridged highs created by the Bata Transform Fault or fracture zone. Apto-Albian source facies may charge the prospect, and several other stratigraphic-structural leads flank the prospect. Similar fracture zone play fairways exist across most of the acreage here from Block 3 in the north to Block 13 in the south.

Depending on the results of the well, a number of follow-on play tests could be drilled by BP to the south in Block 13, Galp and Equator in Block 12, and Shell and Galp, and Oranto in Block 3. Results could also influence activity further afield, where open acreage has similar play concepts in the adjacent north Gabon basin, and also in EG 24 Equatorial Guinea, located between the Ceiba Okume-Ovenge fields and Block 5 STP.

PETER ELLIOTT – NVentures

peter.elliott@nventures.co.uk