The ultimate question every operator faces is whether there is room to arrest the decline of their producing field by investing to increase the recovery factor. One of the most common ways to find out if there is potential to do so is by looking at field analogues: Is there an operator somewhere in the world that manages to squeeze more out of field X than we anticipate doing? There is an answer to that question for sure, but how to start and where to look?

This is where data from subsurface intelligence companies comes in, as it is only by having large global databases that enable someone to perform the screening required to answer this question satisfactorily.

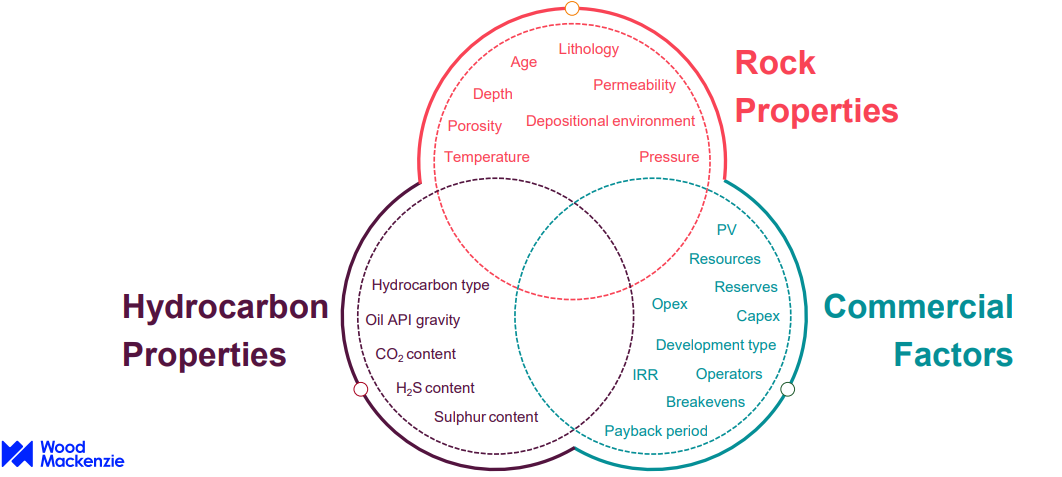

“But it is not only reservoir characteristics such as porosity, permeability and oil viscosity that define whether a field is a good analogue,” says Andrew Latham from Wood Mackenzie. “The performance of the same field may be vastly different depending on which country it is in. In other words, some places promote the application of technology more, or have tax incentives in place to do drill more development wells. That is a very important element to include in your analysis.”

“And customers are aware of this,” Andrew continues. “I recently talked to an operator in the Middle East who only looked at their own country to find good analogues for that very reason.”

The news is swamped with exploration drilling in new frontier areas, but the biggest investments in the upstream oil and gas sector are made towards improving the recovery of existing fields. As such, we want to offer a toolkit that provides our clients the confidence that there is room to make this investment.

However, by doing so, you ignore a large swath of data that will potentially allow you to find an analogue in another location that may be a much better fit. An analogue that may even trigger an investment decision that would otherwise not be made.

“The simple filtering approach that we applied to interrogate our database thus far has proven to return data with insufficient granularity, especially when you include the commercial side of things,” explains Andrew. “The selection that would be returned when applying a specific filter is often too narrow, and, more importantly, there is no ranking provided either.”

“That is where our new AI approach comes in,” he says. “Using AI, we can now sample our database more dynamically, including commercial variables, and return a ranked list of analogues that fulfil the criteria set at the start of the process. Much better than a list of candidates that all fulfil the same criteria without any ranking at all.”