In Asia Pacific, Malaysia has been arguably the most successful country in promoting its exploration and development opportunities over the past few years, with the vast majority of its acreage now licensed. However, Indonesia has been a determined neighbour and is showing no signs of letting up when it comes to promoting exploration blocks, with the latest second phase of the 2024 bid round announced in December 2024. Figure 1 shows the location of the current bid round blocks: Air Komering, Serpang, Kojo, Binaiya, Gaea and Gaea II.

Indonesia has been holding regular bid rounds under improved terms since 2021. They include flexible Production Sharing Contracts (PSCs), which now offer companies the choice between cost recovery and gross split schemes, providing flexibility to select the model that best suits their investment strategies. In addition, efforts have been made to create a more attractive environment for investors in the upstream oil and gas sector. Improvements have been made to fiscal and incentive structures, which help ensure contract certainty, efficiency, and the adoption of advanced technologies. Similar to Malaysia, Indonesia has a membership scheme whereby companies can have full access to non-confidential data, either paid or free, for participants that have already accessed the bid document.

Recent awards and key players

Prior to the launching of the latest bid round, three block awards from the Phase 1 bid round were announced in September 2024, with the most notable award being the Central Andaman PSC to Harbour Energy and Mubadala, where both companies have had success in neighbouring blocks in recent years with an estimated 12 Tcf of gas in-place resources discovered. The other two blocks were awarded to Medco Energi (Amanah, onshore South Sumatra) and a consortium of Pertamina, Sinopec and KUFPEC for the Melati block in onshore southeast Sulawesi.

The bid rounds have had mixed success. Since 2021, less than 50 % of the blocks offered have been awarded, with 22 awards made from a possible 47 on offer. Nevertheless, a variety of companies have made successful bids with awards to majors such as BP and Eni and international NOCs such as Petronas and POSCO. Other awards have included large/medium-sized companies such as Cenovus (Husky Energy) and indigenous EMP (Energi Mega Persada), along with smaller IOCs like Conrad Asia Energy and other small local independents.

Strategic initiatives for exploration success

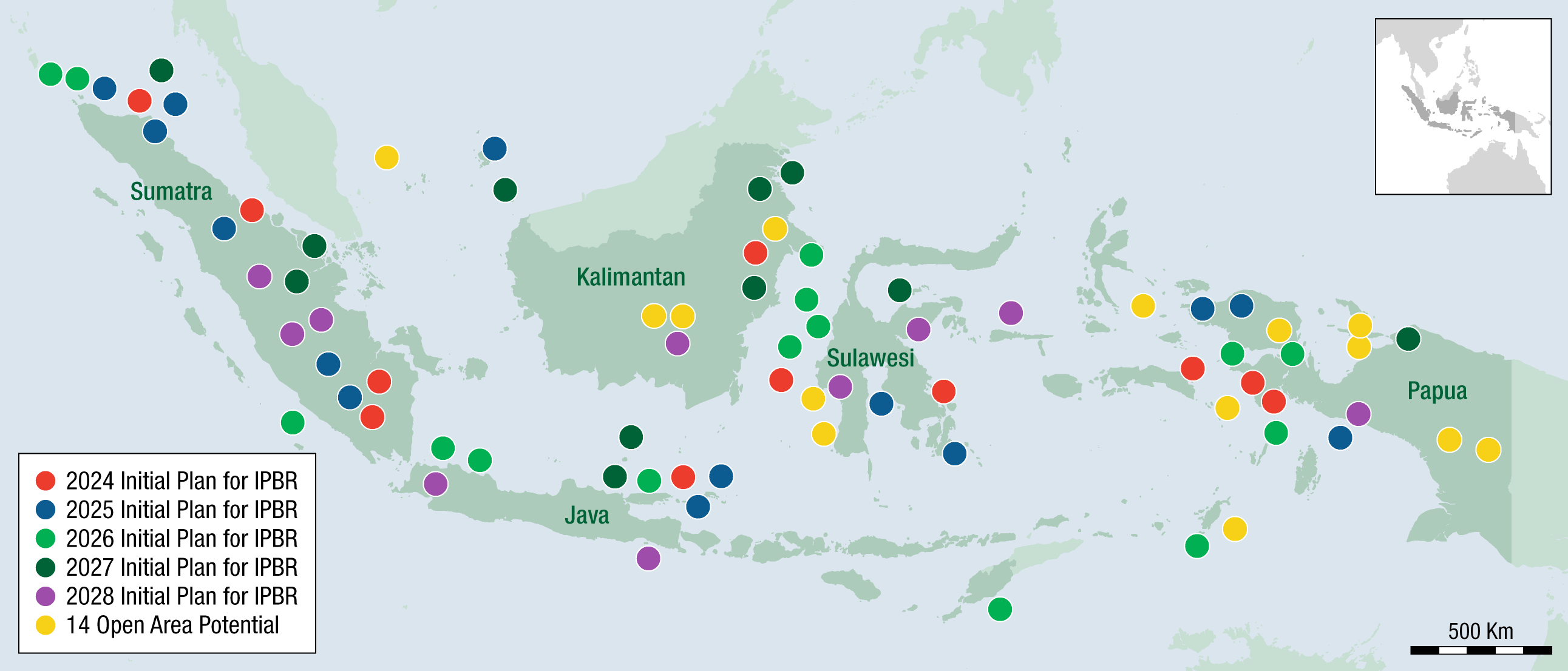

Meanwhile, work continues at pace in the background for the next phases of bid rounds. The Ministry of Energy and Mineral Resources (ESDM) has plans to offer up to 75 potential onshore and offshore blocks through 2028 (Figure 2), with half offered between 2024-26 mainly in western Indonesia. These blocks also include 14 open areas.

To help the Indonesian government better understand its subsurface resources and in turn de-risk and identify areas that are more attractive for exploration and development investment, work is carried out in Joint Study Areas (JSAs) between the ESDM and private companies or consortiums. These studies are conducted to evaluate areas that have not been extensively explored or developed. A further enhancement to the bidding process has been that when these JSA areas are offered, they are under a direct bidding mechanism. Benefits can include terms tailored to the specific potential of the block, reducing administrative delays associated with public tenders, and companies face less competition compared to an open tender, increasing their chances of securing the block.

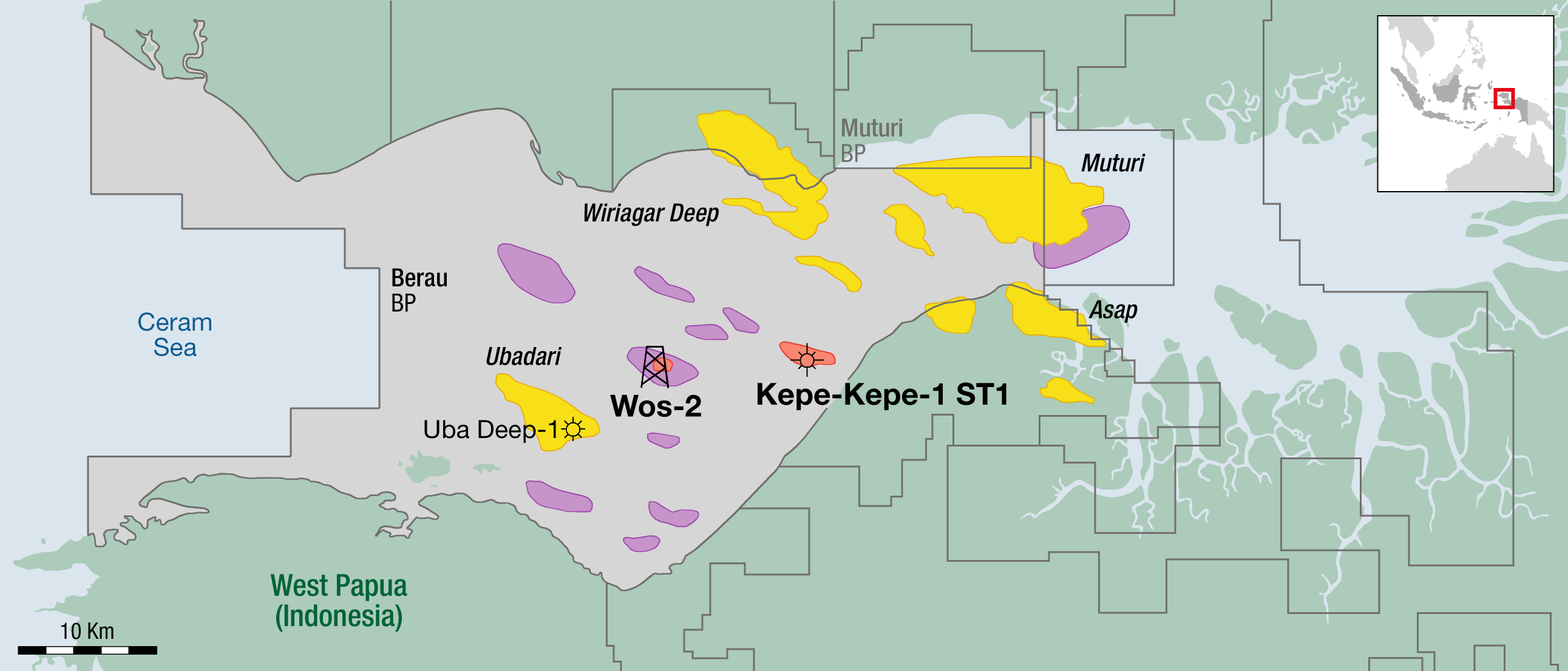

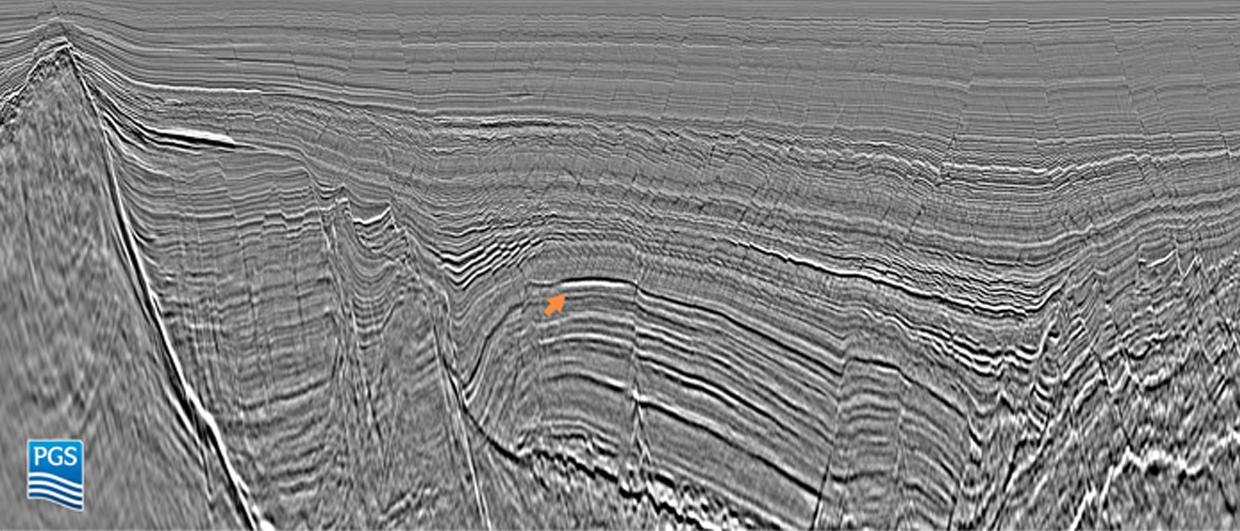

By late December 2024, there were 23 JSAs under study, with a further seven proposed for study. Most of the areas are offshore. These include areas near more established areas such as the Makassar Straits, east of Kalimantan and the Andaman Sea, north of Sumatra. Several JSAs are in frontier or underexplored areas such as West Papua in the Aru Trough, around southern Sulawesi in the Sengkang (Bone) and Buton basins, and north of the giant Abadi gas-condensate field, south of the Yamdena Island in the northern reaches of Bonaparte Basin. The Natuna D-Alpha block is currently under study in the East Natuna Basin, where activity has stagnated but still has significant potential. The block was last offered during the second phase of the 2023 bid round and is likely to resurface in a future bid round. KUFPEC is reportedly interested in the area, currently holding a stake in the Natuna Sea Block A PSC in the West Natuna Basin.

Future drilling and potential impact

In some of the relatively underexplored blocks awarded since 2021, planned wells are expected to start drilling in 2026 and beyond. Should any of these wells prove successful the future bid round push can only improve and help unlock undiscovered resources in a country that, according to ESDM, has 27 basins with proven hydrocarbon resources but not yet in production and 68 basins with limited geological data and exploration activities, such as Papua, Maluku, and deepwater areas.