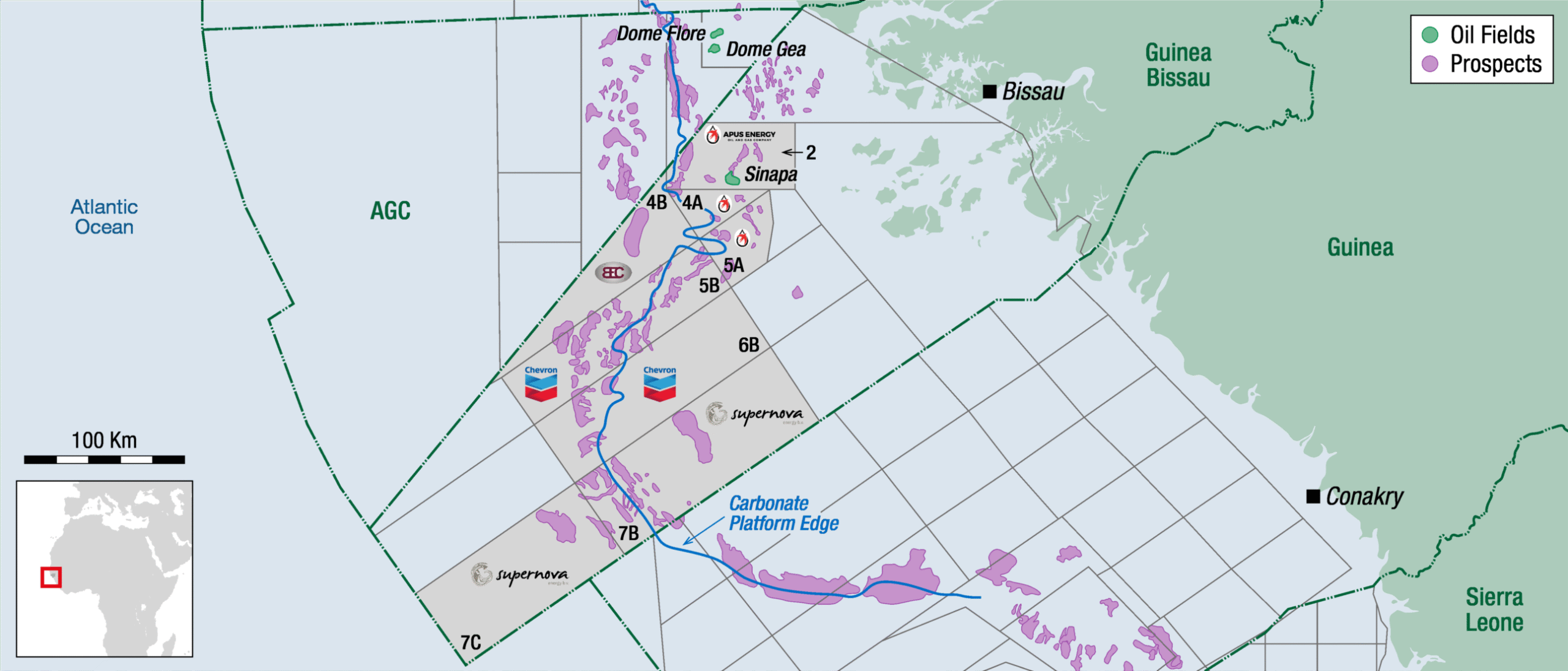

The petroleum provinces of Cote d’Ivoire are amongst the hottest properties in the exploration sector at the moment. While oil and gas regulators and operators work hard to stimulate investment in the Liberia, Harper and Tano basins across the Transform Margin, a hotspot has emerged around the Ivorian Basin on the back of some billion barrel discoveries by Eni and a reported land grab by the supermajors Chevron and Shell. In an industry reluctant to support frontier exploration, explorationists are revealing new world-class plays in West Africa.

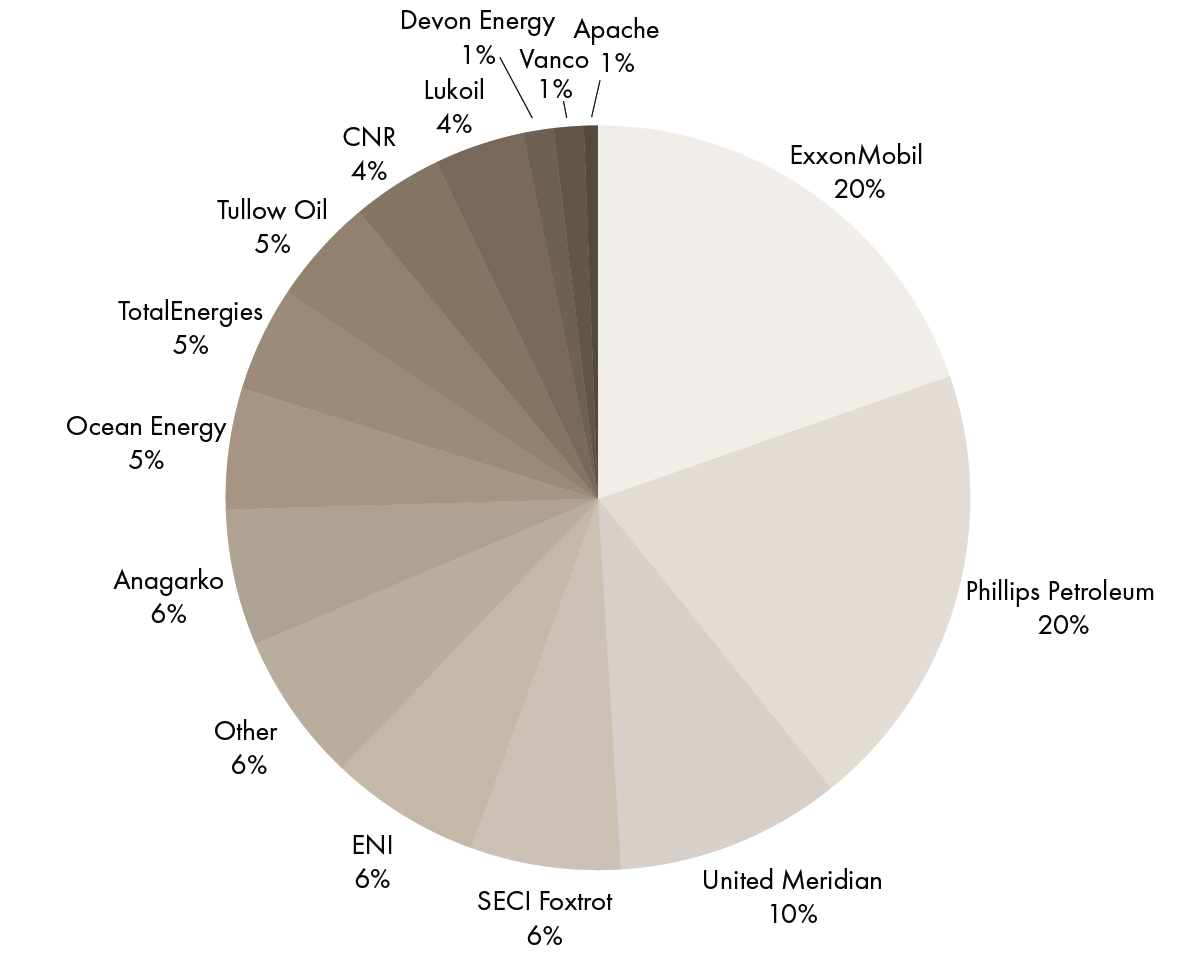

Cote D’Ivoire has a long and successful history in E&P. Whist the “original” majors roamed around Africa looking for the Prize in the 1970s, ExxonMobil drilled a number of small gas and oil discoveries on the shallow water shelf in the east of the country, the “Ivco” wells. By the 1980s, a number of reasonable discoveries had been made, relatively deep water at the time, notably Espoir (Philips). Foxtrot and the associated partners and backers found gas at Foxtrot, and Agip tested gas at Eland. By the 1990s, United Meridian had made a concerted effort in the eastern shelf play, with small discoveries at Kudu, Lion, Ibex, and Panther. Most of these remain undeveloped, apart from Lion / Panther. Devon Energy drilled two shelf prospects in 1998, Hippo 1 and Crocodile 1, with a small discovery of gas condensate at Hippo. As technology improved in the early 2000s, Ranger / CNR took on the Espoir development. Spurred on with success they drilled the Baobab structure, and both fields remain in late-life production. The Canadian pioneers successfully drilled Kossipo soon after. By 2005, Foxtrot had stepped out of their comfort zone at the Foxtrot field and soon added Mahi and Manta.

Two plays

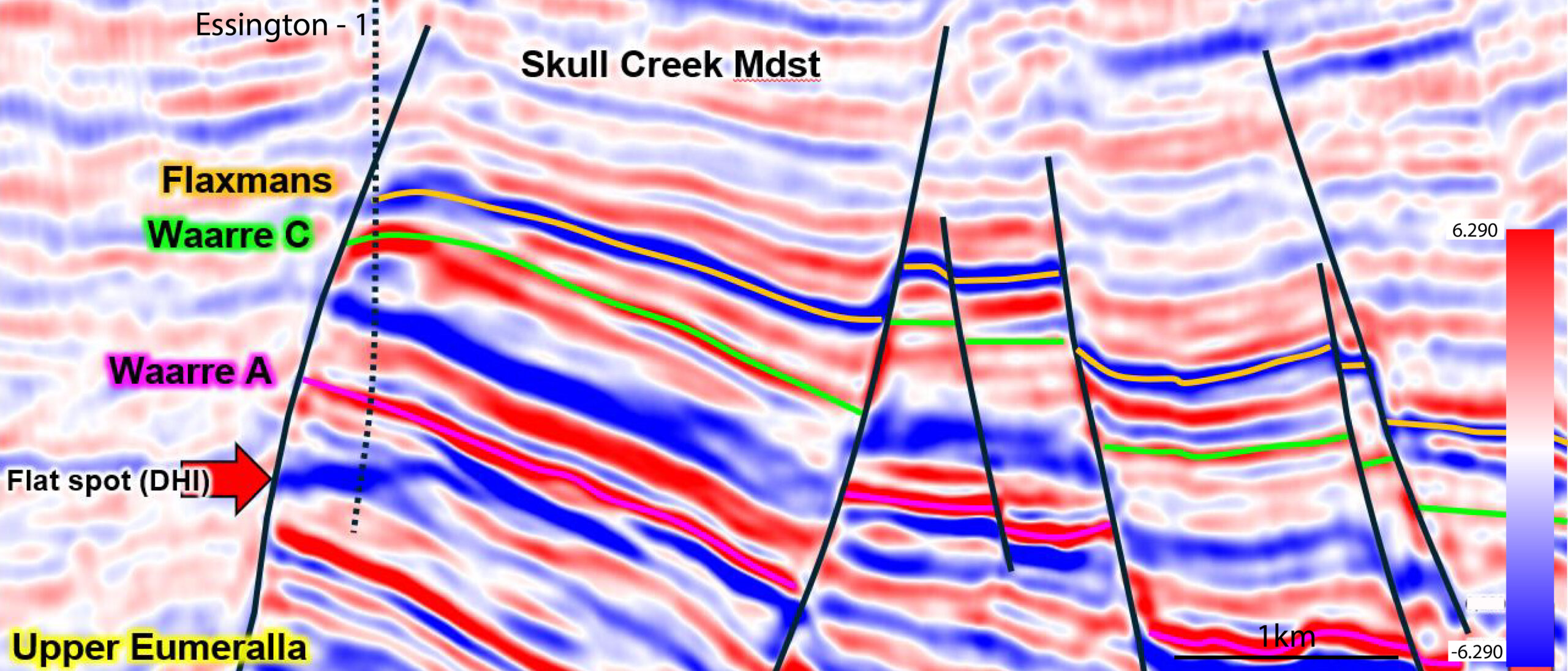

By this point in the story of Ivorian exploration, two main plays had been established; the deeper Lower Cretaceous (Albian) play at Espoir, a structural play usually trapped against the Mid- Cretaceous unconformity, and an Upper Cretaceous play comprising marine clastics from the Cenomanian to the Maastrichtian, usually stratigraphic in nature.

The discovery of Jubilee in Ghana in 2007 turned a lot of exploration ideas on their heads. With deep-water Upper Cretaceous turbidites sourced from world-class CT source rocks, and often with excellent reservoir quality, the Upper Cretaceous deep-water play became the talk of the town. However, the original pioneers at Jubilee proved hard to mimic. It would take until 2023 for a new play sitting right between the Lower and Upper Cretaceous to be finally tested, with great success, by Eni.

The hunt for a jubilee lookalike

The hunt for a Jubilee lookalike consumed vast energy and resources through the 2010s. By 2012, Lukoil had taken up the charge across the WATM, using state-of-the-art 3D seismic and Qualitative Interpretation techniques to identify deep-water fans and turbidite reservoirs. Wells at Independence, Capitaine and Orca successfully defined a series of high-quality turbidite reservoirs defining a trend along the southeastern edge of the Baleine High offshore Cote D’Ivoire, but none with commercial quantities of hydrocarbons.

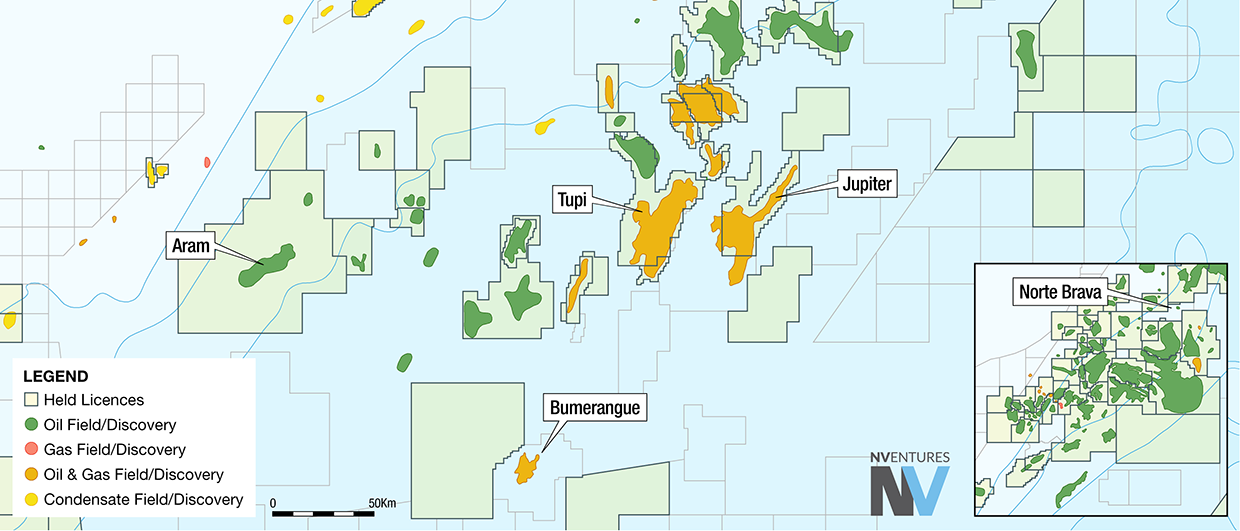

It could be said Vanco lured Lukoil into deep waters, although their first well at Albacore was P&A’d dry. TotalEnergies tested the Ivoire 1X prospect in 2013 with no success. Not put off, operators continued to drill similar prospects. Immediately west of the Baleine “nose” or structural high, Tullow chased the Paon complex of turbidites and channels, whilst Lukoil drilled Buffalo 1X further west. Anadarko took control at Paon and by 2017 around 6 wells had been drilled in the Paon complex, with no sanctioned field development to show for it. Anadarko later became part of the new Occidental empire and the play was left fallow until Murphy took up the call in 2023. Immediately northwest of Paon is the most recent giant oil discovery, Calao, drilled into a deeper Cretaceous play by Eni in 2024 with the Murene 1X well.

Further west still in 2014 and 2015, a number of wells were drilled into the San Pedro Basin. TotalEnergies drilled Saphir 1X (sub-commercial oil), while TotalEnergies and Anadarko tested the Saumon and Morue prospects, both P&A. Genel and Vitol drilled Agile 1X (P&A). Vanco had been the first to test this huge western offshore basin in 2005 with the San Pedro 1 well, funded by ONGC and OIL. The well appeared to top off an extinct volcano and the structure was dry. By 2017 major drilling campaigns had tailed off, although Africa Petroleum Corp and Ophir managed to drill the Ayame West prospect to mark the end of two prolific but unsuccessful West Africa drilling campaigns.

Returning enthusiasm

By 2018, attention was returning to the central and eastern Ivorian basins. TotalEnergies continued to test the Upper Cretaceous play with the Barracuda 1X well and CNR successfully appraised Kossipo. Late 2021, saw Eni pick up a large Albian prospect mapped over the Baleine High by Vanco in 2007. Concentrating on the Albian to Cenomanian “in-between” play in this area, with an unambiguous four-way closure, gas cloud, and both carbonate and clastic reservoirs to target, Eni drilled one of the largest closures in the margin and hit the jackpot with Baleine 1X. Already in 2024, Eni and Petroci are planning Phase III of the Baleine development plan, with first oil achieved in August 2023.

The Eni superhighway

About this time (2021) Tullow and Cairn (now Capricorn) had joined forces onshore the Ivorian Basin, shooting Full Tensor Gravimetry and 2D. However, both firms dropped the acreage amidst zero investment sentiment for new frontier exploration. DNO saw the opportunity to participate in safe production and a thriving gas industry at Foxtrot and bought into CI 27 in 2022. Tullow entered CI 803 later in 2022, although more likely to secure acreage west of their struggling TEN field in Ghana. Svenska, partners in Baobab, had been on the market for a few years, and in 2022 Vaalco made the purchase, joining CNR in CI 40. Seeing the upside around Baleine and the under-evaluated plays north and south of Paon, Murphy made a strident entry into the basin in 2023, taking a wide strip of acreage (5 blocks) through the Paon trend between what would become the “Eni superhighway” with the 2024 Calao discovery to the west (approximately 1.5 Bbo recoverable) and Baleine to the east (3.5 Bboe). Eni themselves have since secured four concessions around the Calao CI 205 Block, further bolstering their hold on this fantastic play.

All roads lead to Abidjan

Looking ahead, all roads lead to Abidjan, as for now, they are racing ahead of their neighbours.

Operators and contractors are busy working the frontier in Cote d’Ivoire. Shell is rumoured to be signing deep-water blocks in Cote D’Ivoire seaward of Baleine and Calao, while Chevron is strongly associated with two deep-water blocks south of Baleine. Murphy might be expected to find partners on very good terms in the near future, and Eni themselves are running a process to find partners with deep pockets and generous terms on their two discoveries and producing assets.