in 2017/18 led to Environmental, Social and Governance (ESG) investment controls which has since stalled Western investment. The global Covid-19 pandemic in late 2019 has only made the problem worse with reduced global demand for fuel with lockdown. It is interesting to note that the net effect was that global emissions reduced by the 30%, that the experts say is needed by 2050 to prevent temperatures rising more than 2°C and a possible climate change tipping point.The Western world’s decision makers appear to think that a realistic energy transition can be achieved by simply switching off all fossil fuels including the hydrocarbons on which the global economy is arguably built and has become entirely dependent. The net result is a potentially unfillable hole in global energy supply.

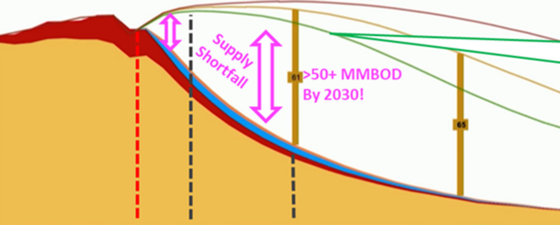

The evidence is clear from an increasing number of respected and trusted intelligence sources. The following graph released by Rystad illustrates clearly to even the most sceptical, that there are simply insufficient existing hydrocarbons resources for the world to transition without additional sources of oil and particularly gas.

All the evidence is that however fast the world builds wind and solar farms, it simply cannot replace hydrocarbons in the near, if not medium or perhaps even longer term. The blackouts in California in summer 2020, and in Texas in the early 2021 winter freeze, shows what happens when there is insufficient switchable generation or spare capacity to ensure security of supply. New Zealand is another reminder of what a ban on all new exploration and production can do in just four years. This has led to them considering re-importing coal to ensure enough power, which is significantly more emissive than the oil and particularly gas it will be replacing.

Gas is rarely compared to other fossil fuels and clearly needs to be recognised as a vital ‘fuel of transition’ that satisfies the 3 As (i.e., achievable, affordable, and acceptable) due to its low emissions compared to oil and particularly coal. The recent and dramatic global gas price rises are perhaps the early signs of this undersupply biting and just a taster of what is to come.

By comparison, it is interesting how the medical experts were wholly involved by the politicians in their decision making in managing the terrible impact that Covid-19 was having on their voting population. As with the global financial crisis in 2008, the signs of a pending crash were equally evident.

The investment community’s current eschewal of E&P now appears equally short-sighted and only likely to increase, not decrease emissions. It is not too late to instigate a realistic approach to a new cycle of exploration, with ESG compliance, to help restore global supplies over the next five years. Currently, 20 years are estimated to be needed for alternative technologies, infrastructure and the changes in lifestyles required for transition to be achievable, affordable, and therefore acceptable. Perhaps the massive commodity price rises that are likely to accompany the supply shortfall will be enough for investors to wake up and see a way of making profits, but sustainably with clear ESG compliance.

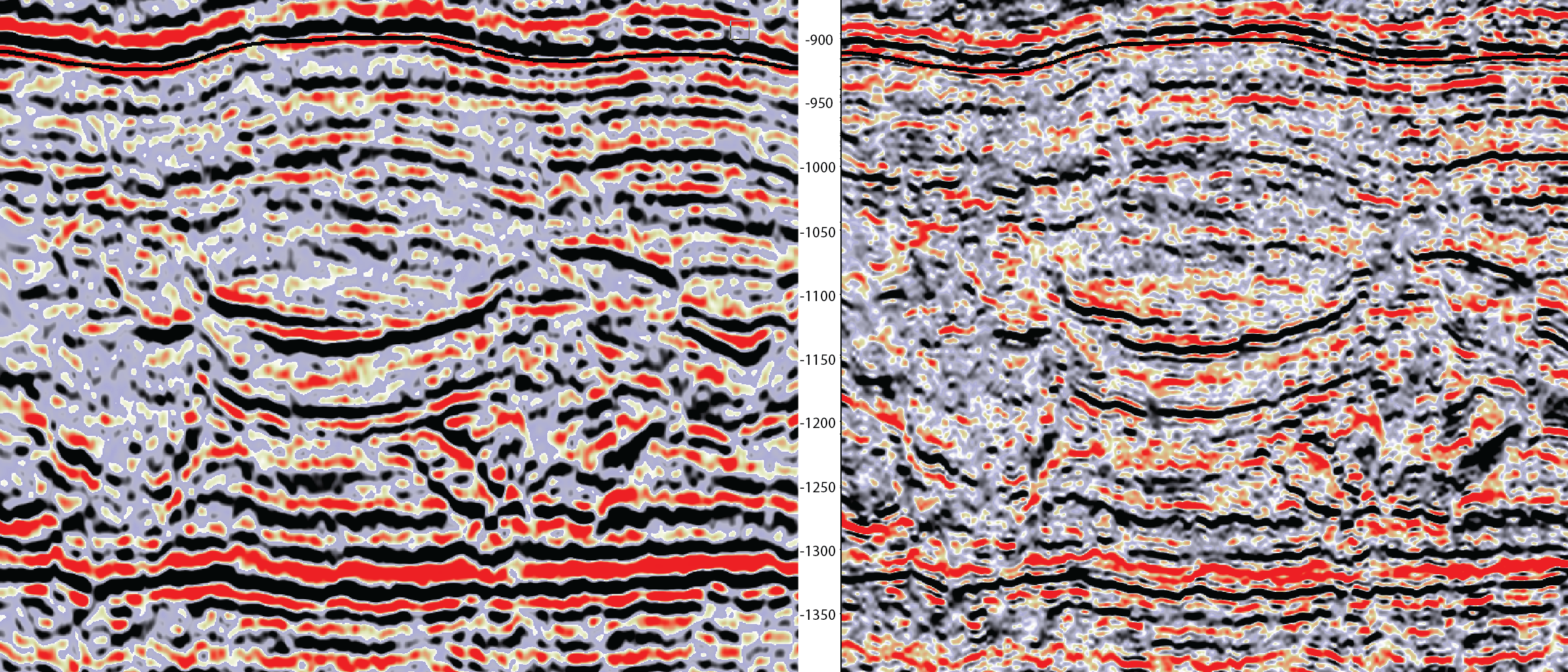

The challenge is that after nearly six years of almost zero E&P investment and subsequent loss of experienced geoscience and engineering teams, few established E&P companies can now grow their exploration capability sufficiently fast, if at all. With a limited pool of experienced geologists and geophysicists who know where to locate the 6” holes to achieve even the historical 1:20 chance of exploration success, it will be challenging to say the least. New exploration techniques and technologies such as AI may advance and improve success rates and cycle times. Time will tell, but a rocky road is predicted.