Plenty of Potential

This landlocked country, long a gaping hole in the hydrocarbons map of South America, currently has no production, despite being sandwiched between gas-rich Bolivia, hydrocarbons-producing Argentina and Brazil, with its vast offshore oilfields. In 2013 the first significant seismic surveys since 1997 were undertaken, including the first ever 3D seismic, which was acquired by President Energy and which led to the company’s drilling success.

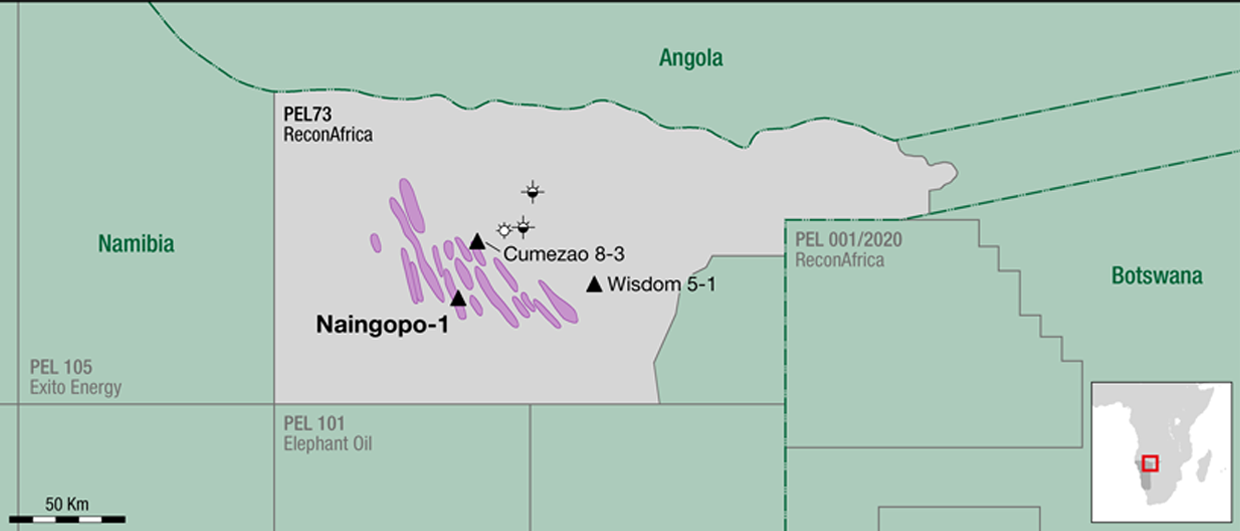

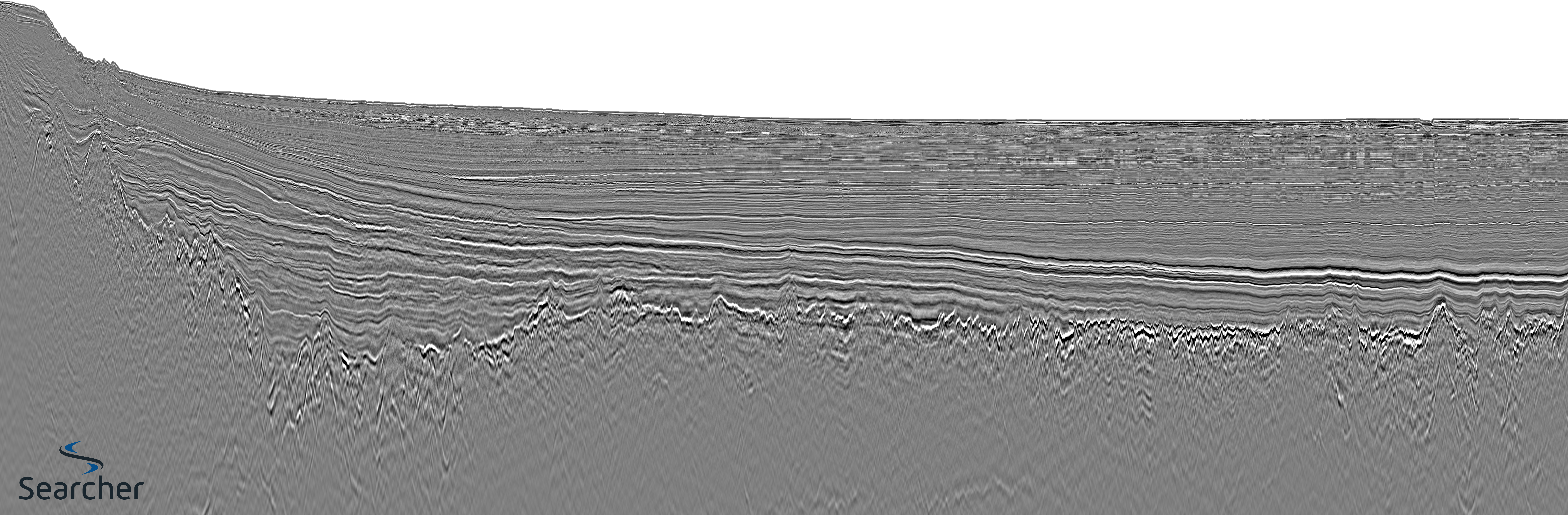

Cleared seismic lines through the Chaco Basin; the results of the seismic survey guided the drilling success. (President Energy)In July 2011 US geoscientists estimated Paraguay’s undiscovered hydrocarbon resource potential to be 27.95 Bboe, of which 27.55 Bboe were estimated for the Palaeozoic and 400 MMboe for the Mesozoic. These estimates include unconventional resource potential in their calculations; Paraguay has an unconventional shale gas resource potential estimate of 62 Tcf. The Chaco Basin is a large sedimentary basin located predominantly in north-western Paraguay and south-eastern Bolivia. The Paraguayan part, where recoverable potential has been estimated at more than 4 Bboe, remains one of the world’s least explored onshore hydrocarbon areas. Several factors render the Paraguayan Chaco Basin attractive for oil and gas exploration and development. These include larger and growing markets for hydrocarbon products, significantly increased oil and gas prices, at least until recently, improved infrastructure in the Chaco and a positive change in the political climate. However, high operating costs pose a threat and it may prove difficult to convince the indigenous groups in the Chaco region that there is potential benefit to a well-managed petroleum industry. In addition, there are a number of stages to the contractual process and it can be time-consuming and lengthy.

A reliance on imports probably explains why the country offers one of the most benign fiscal regimes in the world of hydrocarbons. In April 2013, Horacio Cartes, a businessman first and foremost, won Paraguay’s presidential elections. He has no resource nationalism tendencies, as has been apparent elsewhere in Latin America, and the general consensus is that he will govern from a pro-investment perspective that will benefit the oil and gas industry. Paraguay holds no bid rounds and all contracts in the country are dealt with by the MOPC (Ministry of Public Works and Communications) and its Direccion de Hidrocarburos, a subdivision of the Vice Ministry of Mines and Energy, through an open licensing system. Moves to create a dedicated ministry for energy mines and hydrocarbons were defeated in 2013 but are likely to be revived.