Vagit Alekperov is worried about investment in the oil and gas sector. At a time when his country is waging war in Ukraine, the president of Lukoil, Russia’s leading privately held oil and gas producer, has highlighted the lack of funding for “greenfield and exploration projects to identify new reserves”.

As the tanks roll and large parts of the world put Covid restrictions on the back burner, Alekperov warns that there is a risk of global oil and gas supply shortages in just five years if the current trend of limiting industry investment persists. Even if wind and solar account for 40% of global energy consumption by 2050, he notes, the lack of sufficient available capital for oil and gas projects will see supply struggling to meet demand.

Lukoil, like other Russian companies might well be feeling the pinch on investment at the moment – or at least be worried about the response to its next foray into the market. The pinch for Germany and other EU countries is just as urgent: where do we find alternative, non-Russian supplies of gas. Two different sides of a fossil fuel conundrum in a convoluted, disrupted energy market.

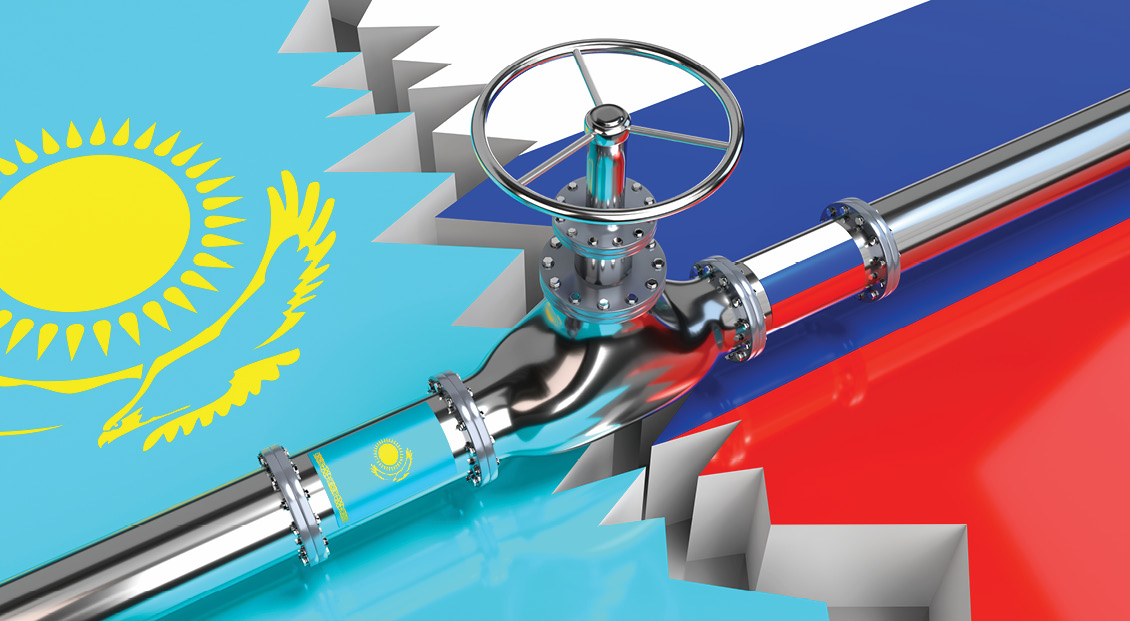

Here’s another example. The authorities in Kazakhstan plan to sell exploration and production licences for a record number of blocks across the country. The target for an offering amounting to 60 blocks in total, say the Kazakh authorities, is international investment which it is claimed will be more suited to the large acreages involved. One caveat to this enthusiastic flash of foreign credit cards: the country relies on Russia to transit its energy exports. Any perception that the tankers might not be able to dock when supplies start flowing (for whatever reason) might just unsettle those potential investors.

For his part, Vagit Alekperov makes a case for oil and gas in the face of transition, not sanctions. The world wants more renewable energy but not quite yet, he argues, and in the short term no-one wants the fossil fuel tap turned off too quickly for whatever reason. If indeed Europe ramps up sanctions on Russia, Lukoil will take comfort in continuing demand from the likes of China and India. Recovery for the company in 2021 was strongest for its acreage outside Russia, especially Uzbekistan, where output jumped by 40% due to stronger demand from – you’ve guessed it – China.

Finally news from the US that the Biden administration is reversing its decision to suspend new licences for oil and gas drilling on public land. Vagit Alekperov would surely approve.